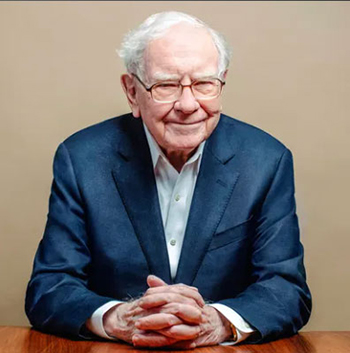

Warren Buffet Sells Puts, You Can Too...

Posted September 19, 2023

Warren Buffet is often described the greatest investor of all time. When he buys a stock, thousands of investors follow suit. There is even a newsletter dedicated to the machinations of the “Oracle of Omaha.” Buffet is such a great investor, not only does he make great stock picks, but he often purchases his stocks at the exact price he chooses!

How?

Buffet sells puts.

One can think of selling a put as a win-win. If a put is exercised a stock is purchased at a pre-agreed strike price. If the purchase occurs at or just slightly below the current stock price, both parties are happy.

Let’s say that you wanted to buy 100 shares of ABC Stock for a long-term position, but at $23 per share it is currently too expensive. You’d be glad to purchase the stock at $20. An owner of the stock next door bought 100 shares of the stock when it was only $11 a share and has held them to see a nice profit. The stockholder also is nervous about an FDA approval pending in three weeks and fears a significant drop in the stock price. So, the two traders take opposite sides of the put contract. You sell the stockholder a $20 put expiring in one month for $1 per share for the lot of 100 shares. You then collect $100 which the stockholder gladly pays for the insurance.

Now what?

The FDA announces that more study is needed to reach a conclusion. The stock drops to $19 per share. The put holder exercises their option and puts the 100 shares to you. you. You are obliged to pay $20 per share. However, remember that you collected $100 when you sold the put. Your cost for the lot of 100 shares has been reduced to $19. You are happy that you were able to acquire the desired stock for less than you had hoped to pay. The stockholder is happy that he was able to collect $20 for the stock. A win-win for both.

Suppose instead the FDA approved the drug and the stock price skyrocketed to $27 per share. Again, both parties are happy. The stockholder keeps the stock and the gain of $4 per share more than offsets the cost of the out. You, the put seller, keep the $100 as a consolation prize for not getting your stock at the desired price.

Up next: Calling Collect – one of the most popular uses of options.